Page 277 - DMGT104_FINANCIAL_ACCOUNTING

P. 277

Unit 12: Corporate Financial Statements

But in the long-run, of course, a company cannot keep spending more money than it takes in. For Notes

companies in trouble, analysts want to keep an eye on the current amount of cash in the bank (to

be sure the company has enough funds on hand to cover its bills). In fact, if the company’s

auditors think that cash-on-hand may not be sufficient to pay the bills (including anticipated

operating losses) in the next few months, they will issue what is called a “going concern”

warning that is attached to the audited financial statement. They are warning investors, in other

words, that the company’s cash stockpile may not be enough the pay the company’s bills, which

usually forces the company to seek bankruptcy protection (hence eliminating its status as a

“going concern”).

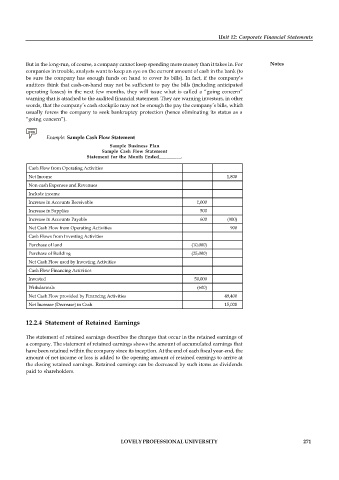

Example: Sample Cash Flow Statement

Sample Business Plan

Sample Cash Flow Statement

Statement for the Month Ended_________.

Cash Flow from Operating Activities

Net Income 1,800

Non-cash Expenses and Revenues

Include income

Increase in Accounts Receivable 1,000

Increase in Supplies 500

Increase in Accounts Payable 600 (900)

Net Cash Flow from Operating Activities 900

Cash Flows from Investing Activities

Purchase of land (10,000)

Purchase of Building (25,000)

Net Cash Flow used by Investing Activities

Cash Flow Financing Activities

Invested 50,000

Withdrawals (600)

Net Cash Flow provided by Financing Activities 49,400

Net Increase (Decrease) in Cash 15,000

12.2.4 Statement of Retained Earnings

The statement of retained earnings describes the changes that occur in the retained earnings of

a company. The statement of retained earnings shows the amount of accumulated earnings that

have been retained within the company since its inception. At the end of each fiscal year-end, the

amount of net income or loss is added to the opening amount of retained earnings to arrive at

the closing retained earnings. Retained earnings can be decreased by such items as dividends

paid to shareholders.

LOVELY PROFESSIONAL UNIVERSITY 271