Page 278 - DMGT104_FINANCIAL_ACCOUNTING

P. 278

Financial Accounting

Notes

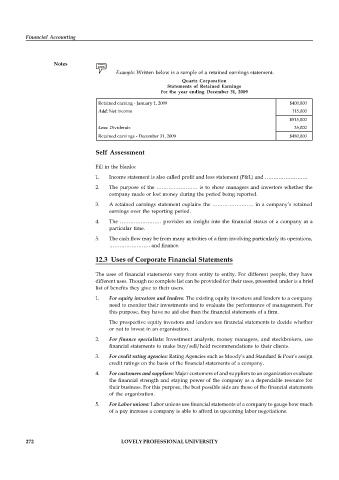

Example: Written below is a sample of a retained earnings statement.

Quartz Corporation

Statements of Retained Earnings

For the year ending December 31, 2009

Retained earning - January 1, 2009 $400,000

Add: Net income 115,000

$515,000

Less: Dividends 35,000

Retained earnings - December 31, 2009 $480,000

Self Assessment

Fill in the blanks:

1. Income statement is also called profit and loss statement (P&L) and …………………….

2. The purpose of the …………………… is to show managers and investors whether the

company made or lost money during the period being reported.

3. A retained earnings statement explains the …………………… in a company’s retained

earnings over the reporting period.

4. The …………………… provides an insight into the financial status of a company at a

particular time.

5. The cash flow may be from many activities of a firm involving particularly its operations,

…………………… and finance.

12.3 Uses of Corporate Financial Statements

The uses of financial statements vary from entity to entity. For different people, they have

different uses. Though no complete list can be provided for their uses, presented under is a brief

list of benefits they give to their users.

1. For equity investors and lenders: The existing equity investors and lenders to a company

need to monitor their investments and to evaluate the performance of management. For

this purpose, they have no aid else than the financial statements of a firm.

The prospective equity investors and lenders use financial statements to decide whether

or not to invest in an organisation.

2. For finance specialists: Investment analysts, money managers, and stockbrokers, use

financial statements to make buy/sell/hold recommendations to their clients.

3. For credit rating agencies: Rating Agencies such as Moody’s and Standard & Poor’s assign

credit ratings on the basis of the financial statements of a company.

4. For customers and suppliers: Major customers of and suppliers to an organization evaluate

the financial strength and staying power of the company as a dependable resource for

their business. For this purpose, the best possible aids are those of the financial statements

of the organization.

5. For Labor unions: Labor unions use financial statements of a company to gauge how much

of a pay increase a company is able to afford in upcoming labor negotiations.

272 LOVELY PROFESSIONAL UNIVERSITY