Page 239 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 239

Cost and Management Accounting

Notes

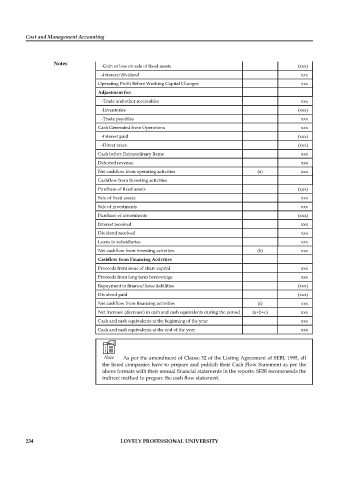

-Gain or loss on sale of fi xed assets (xxx)

-Interest/dividend xxx

Operating Profit Before Working Capital Changes xxx

Adjustment for:

-Trade and other receivables xxx

-Inventories (xxx)

-Trade payables xxx

Cash Generated from Operations xxx

-Interest paid (xxx)

-Direct taxes (xxx)

Cash before Extraordinary Items xxx

Deferred revenue xxx

Net cashflow from operating activities (a) xxx

Cashflow from Investing activities

Purchase of fi xed assets (xxx)

Sale of fi xed assets xxx

Sale of investments xxx

Purchase of investments (xxx)

Interest received xxx

Dividend received xxx

Loans to subsidiaries xxx

Net cashflow from investing activities (b) xxx

Cashflow from Financing Activities

Proceeds from issue of share capital xxx

Proceeds from long term borrowings xxx

Repayment to fi nance/lease liabilities (xxx)

Dividend paid (xxx)

Net cashfl ow from fi nancing activities (c) xxx

Net Increase (decrease) in cash and cash equivalents during the period (a+b+c) xxx

Cash and cash equivalents at the beginning of the year xxx

Cash and cash equivalents at the end of the year xxx

Note As per the amendment of Clause 32 of the Listing Agreement of SEBI, 1995, all

the listed companies have to prepare and publish their Cash Flow Statement as per the

above formats with their annual financial statements in the reports. SEBI recommends the

indirect method to prepare the cash fl ow statement.

234 LOVELY PROFESSIONAL UNIVERSITY