Page 240 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 240

Unit 13: Cash Flow Analysis (As Per AS-3)

Notes

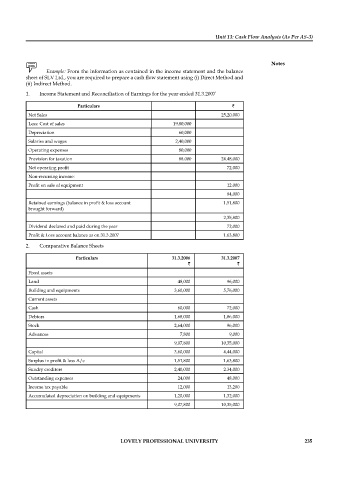

Example: From the information as contained in the income statement and the balance

sheet of SLV Ltd., you are required to prepare a cash flow statement using (i) Direct Method and

(ii) Indirect Method.

1. Income Statement and Reconciliation of Earnings for the year ended 31.3.2007

Particulars `

Net Sales 25,20,000

Less: Cost of sales 19,80,000

Depreciation 60,000

Salaries and wages 2,40,000

Operating expenses 80,000

Provision for taxation 88.000 24.48,000

Net operating profi t 72,000

Non-recurring income:

Profit on sale of equipment 12.000

84,000

Retained earnings (balance in profit & loss account 1,51,800

brought forward)

2,35,800

Dividend declared and paid during the year 72,000

Profit & Loss account balance as on 31.3.2007 1.63,800

2. Comparative Balance Sheets

Particulars 31.3.2006 31.3.2007

` `

Fixed assets

Land 48,000 96,000

Building and equipments 3,60,000 5,76,000

Current assets

Cash 60,000 72,000

Debtors 1,68,000 1,86,000

Stock 2,64,000 96,000

Advances 7,800 9,000

9,07,800 10,35,000

Capital 3,60,000 4,44,000

Surplus in profit & loss A/c 1,51,800 1,63,800

Sundry creditors 2,40,000 2.34,000

Outstanding expenses 24,000 48,000

Income tax payable 12,000 13,200

Accumulated depreciation on building and equipments 1,20,000 1,32,000

9,07,800 10,35,000

LOVELY PROFESSIONAL UNIVERSITY 235