Page 242 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 242

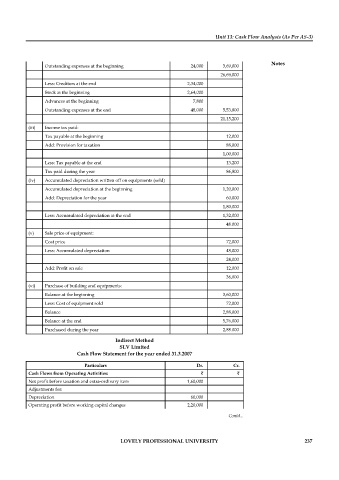

Unit 13: Cash Flow Analysis (As Per AS-3)

Notes

Outstanding expenses at the beginning 24,000 3,69,000

26,69,000

Less: Creditors at the end 2,34,000

Stock at the beginning 2,64,000

Advances at the beginning 7,800

Outstanding expenses at the end 48,000 5,53,800

21,15,200

(iii) Income tax paid:

Tax payable at the beginning 12,000

Add: Provision for taxation 88,000

1,00,000

Less: Tax payable at the end 13,200

Tax paid during the year 86,800

(iv) Accumulated depreciation written off on equipments (sold)

Accumulated depreciation at the beginning 1,20,000

Add: Depreciation for the year 60,000

1,80,000

Less: Accumulated depreciation at the end 1,32,000

48.000

(v) Sale price of equipment:

Cost price 72,000

Less: Accumulated depreciation 48,000

24,000

Add: Profit on sale 12,000

36,000

(vi) Purchase of building and equipments:

Balance at the beginning 3,60,000

Less: Cost of equipment sold 72,000

Balance 2,88,000

Balance at the end 5,76,000

Purchased during the year 2,88.000

Indirect Method

SLV Limited

Cash Flow Statement for the year ended 31.3.2007

Particulars Dr. Cr.

Cash Flows from Operating Activities: ` `

Net profit before taxation and extra-ordinary item 1,60,000

Adjustments for:

Depreciation 60,000

Operating profit before working capital changes 2,20,000

Contd...

LOVELY PROFESSIONAL UNIVERSITY 237