Page 244 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 244

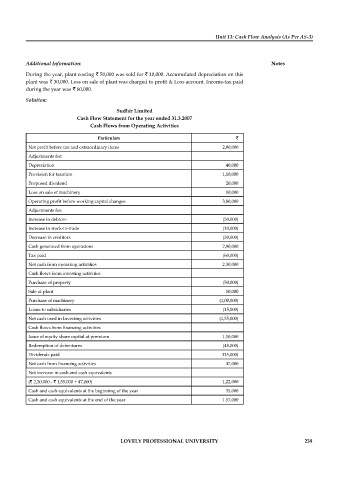

Unit 13: Cash Flow Analysis (As Per AS-3)

Additional Information: Notes

During the year, plant costing ` 50,000 was sold for ` 10,000. Accumulated depreciation on this

plant was ` 30,000. Loss on sale of plant was charged to profit & Loss account. Income-tax paid

during the year was ` 60,000.

Solution:

Sudhir Limited

Cash Flow Statement for the year ended 31.3.2007

Cash Flows from Operating Activities

Particulars `

Net profit before tax and extraordinary items 2,00,000

Adjustments for:

Depreciation 40,000

Provision for taxation 1,10,000

Proposed dividend 20,000

Loss on sale of machinery 10,000

Operating profit before working capital changes 3,80,000

Adjustments for:

Increase in debtors (50,000)

Increase in stock-in-trade (10,000)

Decrease in creditors (30,000)

Cash generated from operations 2,90,000

Tax paid (60,000)

Net cash from operating activities 2.30,000

Cash flows from investing activities

Purchase of property (50,000)

Sale of plant 10,000

Purchase of machinery (1,00,000)

Loans to subsidiaries (15,000)

Net cash used in Investing activities (1,55,000)

Cash fl ows from fi nancing activities

Issue of equity share capital at premium 1,10,000

Redemption of debentures (48,000)

Dividends paid 115,000)

Net cash from fi nancing activities 47,000

Net increase in cash and cash equivalents

(` 2,30,000 - ` 1,55,000 + 47,000) 1,22,000

Cash and cash equivalents at the beginning of the year 35,000

Cash and cash equivalents at the end of the year 1.57,000

LOVELY PROFESSIONAL UNIVERSITY 239