Page 243 - DMGT202_COST_AND_MANAGEMENT_ACCOUNTING

P. 243

Cost and Management Accounting

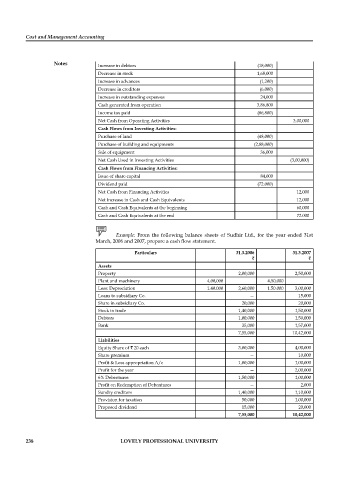

Notes Increase in debtors (18,000)

Decrease in stock 1,68,000

Increase in advances (1,200)

Decrease in creditors (6,000)

Increase in outstanding expenses 24,000

Cash generated from operation 3,86,800

Income tax paid (86,800)

Net Cash from Operating Activities 3,00,000

Cash Flows from Investing Activities:

Purchase of land (48,000)

Purchase of building and equipments (2,88,000)

Sale of equipment 36,000

Net Cash Used in Investing Activities (3,00,000)

Cash Flows from Financing Activities:

Issue of share capital 84,000

Dividend paid (72.000)

Net Cash from Financing Activities 12,000

Net Increase in Cash and Cash Equivalents 12,000

Cash and Cash Equivalents at the beginning 60,000

Cash and Cash Equivalents at the end 72.000

Example: From the following balance sheets of Sudhir Ltd., for the year ended 31st

March, 2006 and 2007, prepare a cash fl ow statement.

Particulars 31.3.2006 31.3.2007

` `

Assets

Property 2,00,000 2,50,000

Plant and machinery 4,00,000 4,50,000

Less: Depreciation 1.40.000 2,60,000 1.50.000 3,00,000

Loans to subsidiary Co. — 15,000

Share in subsidiary Co. 20,000 20,000

Stock in trade 1,40,000 1,50,000

Debtors 1,00,000 1,50,000

Bank 35,000 1,57,000

7,55,000 10,42,000

Liabilities

Equity Share of ` 20 each 3,00,000 4,00,000

Share premium — 10,000

Profit & Loss appropriation A/c 1,00,000 1,00,000

Profit for the year — 2,00,000

6% Debentures 1,50,000 1,00,000

Profit on Redemption of Debentures — 2,000

Sundry creditors 1,40,000 1,10,000

Provision for taxation 50,000 1,00,000

Proposed dividend 15,000 20,000

7,55,000 10,42,000

238 LOVELY PROFESSIONAL UNIVERSITY