Page 140 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 140

Unit 6: Financial Statements: Analysis and Interpretation

Notes

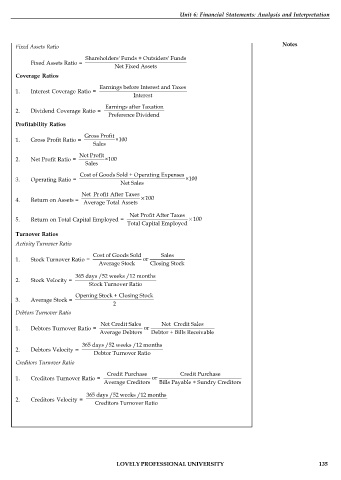

Fixed Assets Ratio

Shareholders' Funds + Outsiders' Funds

Fixed Assets Ratio =

Net Fixed Assets

Coverage Ratios

Earnings before Interest and Taxes

1. Interest Coverage Ratio =

Interest

Earnings after Taxation

2. Dividend Coverage Ratio =

Preference Dividend

Profitability Ratios

Gross Profit

1. Gross Profit Ratio = ×100

Sales

Net Profit

2. Net Profit Ratio = ×100

Sales

Cost of Goods Sold + Operating Expenses

3. Operating Ratio = ×100

Net Sales

Net Profit After Taxes

4. Return on Assets = 100

Average Total Assets

Net Profit After Taxes

5. Return on Total Capital Employed = 100

Total Capital Employed

Turnover Ratios

Activity Turnover Ratio

Cost of Goods Sold Sales

1. Stock Turnover Ratio = or

Average Stock Closing Stock

365 days /52 weeks /12 months

2. Stock Velocity =

Stock Turnover Ratio

Opening Stock + Closing Stock

3. Average Stock =

2

Debtors Turnover Ratio

Net Credit Sales Net Credit Sales

1. Debtors Turnover Ratio = or

Average Debtors Debtor + Bills Receivable

365 days /52 weeks /12 months

2. Debtors Velocity =

Debtor Turnover Ratio

Creditors Turnover Ratio

Credit Purchase Credit Purchase

1. Creditors Turnover Ratio = or

Average Creditors Bills Payable + Sundry Creditors

365 days /52 weeks /12 months

2. Creditors Velocity =

Creditors Turnover Ratio

LOVELY PROFESSIONAL UNIVERSITY 135