Page 212 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 212

Unit 11: Taxation Planning

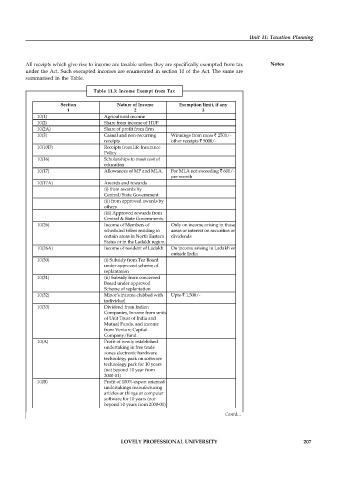

All receipts which give rise to income are taxable unless they are specifically exempted from tax Notes

under the Act. Such exempted incomes are enumerated in section 10 of the Act. The same are

summarised in the Table.

Table 11.3: Income Exempt from Tax

Section Nature of Income Exemption limit, if any

1 2 3

10(1) Agricultural income

10(2) Share from income of HUF

10(2A) Share of profit from firm

10(3) Casual and non-recurring Winnings from races ` 2500/-

receipts other receipts ` 5000/-

10(10D) Receipts from life Insurance

Policy

10(16) Scholarships to meet cost of

education

10(17) Allowances of MP and MLA. For MLA not exceeding ` 600/-

per month

10(17A) Awards and rewards

(i) from awards by

Central/State Government

(ii) from approved awards by

others

(iii) Approved rewards from

Central & State Governments

10(26) Income of Members of Only on income arising in those

scheduled tribes residing in areas or interest on securities or

certain areas in North Eastern dividends

States or in the Ladakh region.

10(26A) Income of resident of Ladakh On income arising in Ladakh or

outside India

10(30) (i) Subsidy from Tea Board

under approved scheme of

replantation

10(31) (ii) Subsidy from concerned

Board under approved

Scheme of replantation

10(32) Minor's income clubbed with Upto ` 1,500/-

individual

10(33) Dividend from Indian

Companies, Income from units

of Unit Trust of India and

Mutual Funds, and income

from Venture Capital

Company/fund.

10(A) Profit of newly established

undertaking in free trade

zones electronic hardware

technology park on software

technology park for 10 years

(net beyond 10 year from

2000-01)

10(B) Profit of 100% export oriented

undertakings manufacturing

articles or things or computer

software for 10 years (not

beyond 10 years from 2000-01)

Contd...

LOVELY PROFESSIONAL UNIVERSITY 207