Page 213 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 213

Personal Financial Planning

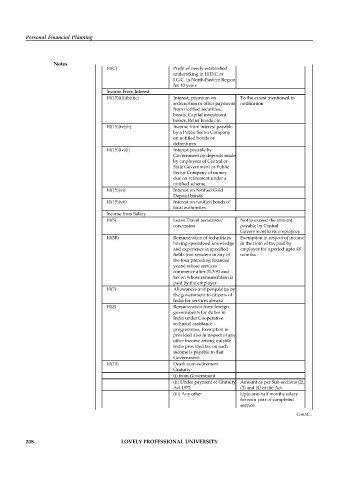

Notes

10(C) Profit of newly established

undertaking in I.I.D.C or

I.G.C. in North-Eastern Region

for 10 years

Income From Interest

10(15)(i)(iib)(iic) Interest, premium on To the extent mentioned in

redemption or other payments notification

from notified securities,

bonds, Capital investment

bonds, Relief bonds etc.

10(15)(iv)(h) Income from interest payable

by a Public Sector Company

on notified bonds or

debentures

10(15)(iv)(i) Interest payable by

Government on deposits made

by employees of Central or

State Government or Public

Sector Company of money

due on retirement under a

notified scheme

10(15)(vi) Interest on notified Gold

Deposit bonds

10(15)(vii) Interest on notified bonds of

local authorities

Income from Salary

10(5) Leave Travel assistance/ Not to exceed the amount

concession payable by Central

Government to its employees

10(5B) Remuneration of technicians Exemption in respect of income

having specialised knowledge in the from of tax paid by

and experience in specified employer for a period upto 48

fields (not resident in any of months

the four preceding financial

years) whose services

commence after 31.3.93 and

tax on whose remuneration is

paid by the employer

10(7) Allowances and perquisites by

the government to citizens of

India for services abroad

10(8) Remuneration from foreign

governments for duties in

India under Cooperative

technical assistance

programmes. Exemption is

provided also in respect of any

other income arising outside

India provided tax on such

income is payable to that

Government.

10(10) Death-cum-retirement

Gratuity-

(i) from Government

(ii) Under payment of Gratuity Amount as per Sub-sections (2),

Act 1972 (3) and (4) of the Act.

(iii) Any other Upto one-half months salary

for each year of completed

service.

Contd...

208 LOVELY PROFESSIONAL UNIVERSITY