Page 214 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 214

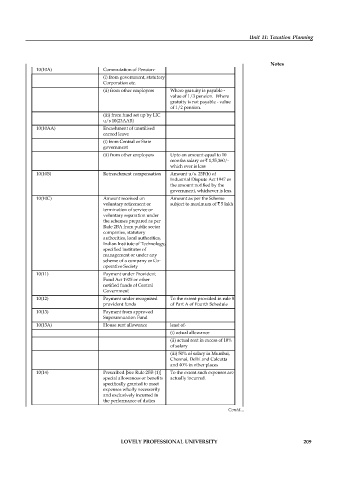

Unit 11: Taxation Planning

Notes

10(10A) Commutation of Pension-

(i) from government, statutory

Corporation etc.

(ii) from other employers Where gratuity is payable -

value of 1/3 pension. Where

gratuity is not payable - value

of 1/2 pension.

(iii) from fund set up by LIC

u/s 10(23AAB)

10(10AA) Encashment of unutilised

earned leave

(i) from Central or State

government

(ii) from other employers Upto an amount equal to 10

months salary or ` 1,35,360/-

which ever is less

10(10B) Retrenchment compensation Amount u/s. 25F(b) of

Industrial Dispute Act 1947 or

the amount notified by the

government, whichever is less.

10(10C) Amount received on Amount as per the Scheme

voluntary retirement or subject to maximum of ` 5 lakh

termination of service or

voluntary separation under

the schemes prepared as per

Rule 2BA from public sector

companies, statutory

authorities, local authorities,

Indian Institute of Technology,

specified institutes of

management or under any

scheme of a company or Co-

operative Society

10(11) Payment under Provident

Fund Act 1925 or other

notified funds of Central

Government

10(12) Payment under recognised To the extent provided in rule 8

provident funds of Part A of Fourth Schedule

10(13) Payment from approved

Superannuation Fund

10(13A) House rent allowance least of-

(i) actual allowance

(ii) actual rent in excess of 10%

of salary

(iii) 50% of salary in Mumbai,

Chennai, Delhi and Calcutta

and 40% in other places

10(14) Prescribed [See Rule 2BB (1)] To the extent such expenses are

special allowances or benefits actually incurred.

specifically granted to meet

expenses wholly necessarily

and exclusively incurred in

the performance of duties

Contd...

LOVELY PROFESSIONAL UNIVERSITY 209