Page 216 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 216

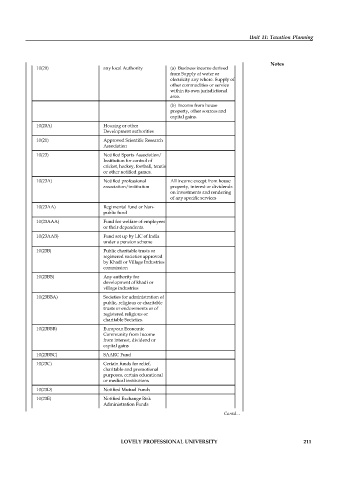

Unit 11: Taxation Planning

Notes

10(20) any local Authority (a) Business income derived

from Supply of water or

electricity any where. Supply of

other commodities or service

within its own jurisdictional

area.

(b) Income from house

property, other sources and

capital gains.

10(20A) Housing or other

Development authorities

10(21) Approved Scientific Research

Association

10(23) Notified Sports Association/

Institution for control of

cricket, hockey, football, tennis

or other notified games.

10(23A) Notified professional All income except from house

association/institution property, interest or dividends

on investments and rendering

of any specific services

10(23AA) Regimental fund or Non-

public fund

10(23AAA) Fund for welfare of employees

or their dependents.

10(23AAB) Fund set up by LIC of India

under a pension scheme

10(23B) Public charitable trusts or

registered societies approved

by Khadi or Village Industries

commission

10(23BB) Any authority for

development of khadi or

village industries

10(23BBA) Societies for administration of

public, religious or charitable

trusts or endowments or of

registered religious or

charitable Societies.

10(23BBB) European Economic

Community from Income

from interest, dividend or

capital gains

10(23BBC) SAARC Fund

10(23C) Certain funds for relief,

charitable and promotional

purposes, certain educational

or medical institutions

10(23D) Notified Mutual Funds

10(23E) Notified Exchange Risk

Administration Funds

Contd...

LOVELY PROFESSIONAL UNIVERSITY 211