Page 215 - DMGT515_PERSONAL_FINANCIAL_PLANNING

P. 215

Personal Financial Planning

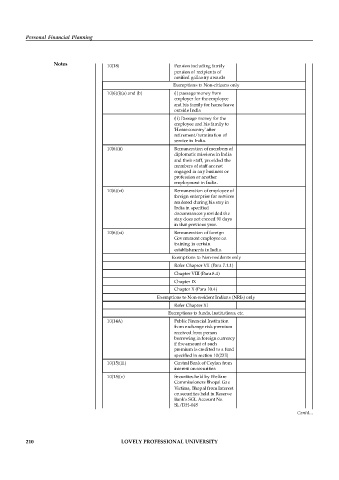

Notes 10(18) Pension including family

pension of recipients of

notified gallantry awards

Exemptions to Non-citizens only

10(6)(i)(a) and (b) (i) passage money from

employer for the employee

and his family for home leave

outside India

(ii) Passage money for the

employee and his family to

'Home country' after

retirement/termination of

service in India.

10(6)(ii) Remuneration of members of

diplomatic missions in India

and their staff, provided the

members of staff are not

engaged in any business or

profession or another

employment in India.

10(6)(vi) Remuneration of employee of

foreign enterprise for services

rendered during his stay in

India in specified

circumstances provided the

stay does not exceed 90 days

in that previous year.

10(6)(xi) Remuneration of foreign

Government employee on

training in certain

establishments in India.

Exemptions to Non-residents only

Refer Chapter VII (Para 7.1.1)

Chapter VIII (Para 8.4)

Chapter IX

Chapter X (Para 10.4)

Exemptions to Non-resident Indians (NRIs) only

Refer Chapter XI

Exemptions to funds, institutions, etc.

10(14A) Public Financial Institution

from exchange risk premium

received from person

borrowing in foreign currency

if the amount of such

premium is credited to a fund

specified in section 10(23E)

10(15)(iii) Central Bank of Ceylon from

interest on securities

10(15)(v) Securities held by Welfare

Commissioners Bhopal Gas

Victims, Bhopal from Interest

on securities held in Reserve

Bank's SGL Account No.

SL/DH-048

Contd...

210 LOVELY PROFESSIONAL UNIVERSITY