Page 187 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 187

International Financial Management

Notes The figures in brackets show the exchange rate used to translate the respective items in the

balance sheet.

Under the current rate method, the exchange loss is $300 because all accounts except net worth

are translated at the current exchange rate.

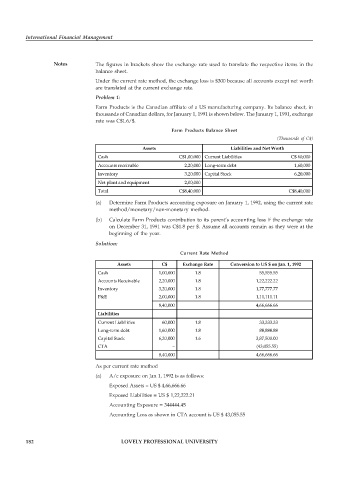

Problem 1:

Farm Products is the Canadian affiliate of a US manufacturing company. Its balance sheet, in

thousands of Canadian dollars, for January 1, 1991 is shown below. The January 1, 1991, exchange

rate was C$1.6/$.

Farm Products Balance Sheet

(Thousands of C$)

Assets Liabilities and Net Worth

Cash C$1,00,000 Current Liabilities C$ 60,000

Accounts receivable 2,20,000 Long-term debt 1,60,000

Inventory 3,20,000 Capital Stock 6,20,000

Net plant and equipment 2,00,000

Total C$8,40,000 C$8,40,000

(a) Determine Farm Products accounting exposure on January 1, 1992, using the current rate

method/monetary/non-monetary method.

(b) Calculate Farm Products contribution to its parent’s accounting loss if the exchange rate

on December 31, 1991 was C$1.8 per $. Assume all accounts remain as they were at the

beginning of the year.

Solution:

Current Rate Method

Assets C$ Exchange Rate Conversion to US $ on Jan. 1, 1992

Cash 1,00,000 1.8 55,555.55

Accounts Receivable 2,20,000 1.8 1,22,222.22

Inventory 3,20,000 1.8 1,77,777.77

P&E 2,00,000 1.8 1,11,111.11

8,40,000 4,66,666.66

Liabilities

Current Liabilities 60,000 1.8 33,333.33

Long-term debt 1,60,000 1.8 88,888.88

Capital Stock 6,20,000 1.6 3,87,500.00

CTA – (43,055.55)

8,40,000 4,66,666.66

As per current rate method

(a) A/c exposure on Jan 1, 1992 is as follows:

Exposed Assets = US $ 4,66,666.66

Exposed Liabilities = US $ 1,22,222.21

Accounting Exposure = 344444.45

Accounting Loss as shown in CTA account is US $ 43,055.55

182 LOVELY PROFESSIONAL UNIVERSITY