Page 192 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 192

Unit 11: Management of Translation Exposure

Notes

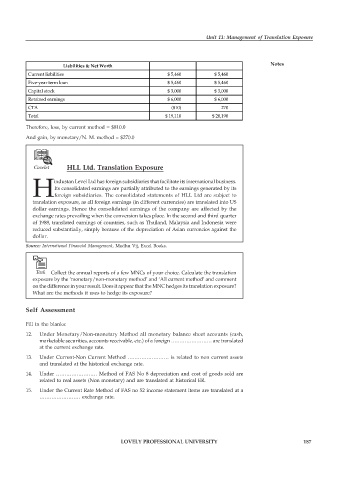

Liabilities & Net Worth

Current liabilities $ 5,460 $ 5,460

Five-year term loan $ 5,460 $ 5,460

Capital stock $ 3,000 $ 3,000

Retained earnings $ 6,000 $ 6,000

CTA (810) 270

Total $ 19,110 $ 20,190

Therefore, loss, by current method = $810.0

And gain, by monetary/N. M. method = $270.0

Caselet HLL Ltd. Translation Exposure

industan Level Ltd has foreign subsidiaries that facilitate its international business.

Its consolidated earnings are partially attributed to the earnings generated by its

Hforeign subsidiaries. The consolidated statements of HLL Ltd are subject to

translation exposure, as all foreign earnings (in different currencies) are translated into US

dollar earnings. Hence the consolidated earnings of the company are affected by the

exchange rates prevailing when the conversion takes place. In the second and third quarter

of 1988, translated earnings of countries, such as Thailand, Malaysia and Indonesia were

reduced substantially, simply because of the depreciation of Asian currencies against the

dollar.

Source: International Financial Management, Madhu Vij, Excel Books.

Task Collect the annual reports of a few MNCs of your choice. Calculate the translation

exposure by the ‘monetary/non-monetary method’ and ‘All current method’ and comment

on the difference in your result. Does it appear that the MNC hedges its translation exposure?

What are the methods it uses to hedge its exposure?

Self Assessment

Fill in the blanks:

12. Under Monetary/Non-monetary Method all monetary balance sheet accounts (cash,

marketable securities, accounts receivable, etc.) of a foreign …………………… are translated

at the current exchange rate.

13. Under Current-Non Current Method …………………… is related to non current assets

and translated at the historical exchange rate.

14. Under …………………… Method of FAS No 8 depreciation and cost of goods sold are

related to real assets (Non monetary) and are translated at historical ER.

15. Under the Current Rate Method of FAS no 52 income statement items are translated at a

…………………… exchange rate.

LOVELY PROFESSIONAL UNIVERSITY 187