Page 191 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 191

International Financial Management

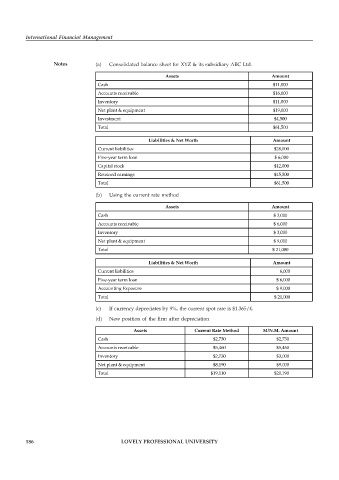

Notes (a) Consolidated balance sheet for XYZ & its subsidiary ABC Ltd.

Assets Amount

Cash $11,000

Accounts receivable $16,000

Inventory $11,000

Net plant & equipment $19,000

Investment $4,500

Total $61,500

Liabilities & Net Worth Amount

Current liabilities $28,000

Five-year term loan $ 6,000

Capital stock $12,000

Retained earnings $15,500

Total $61,500

(b) Using the current rate method

Assets Amount

Cash $ 3,000

Accounts receivable $ 6,000

Inventory $ 3,000

Net plant & equipment $ 9,000

Total $ 21,000

Liabilities & Net Worth Amount

Current liabilities 6,000

Five-year term loan $ 6,000

Accounting Exposure $ 9,000

Total $ 21,000

(c) If currency depreciates by 9%, the current spot rate is $1.365/£.

(d) New position of the firm after depreciation

Assets Current Rate Method M/N.M. Amount

Cash $2,730 $2,730

Accounts receivable $5,460 $5,460

Inventory $2,730 $3,000

Net plant & equipment $8,190 $9,000

Total $19,110 $20,190

186 LOVELY PROFESSIONAL UNIVERSITY