Page 193 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 193

International Financial Management

Notes

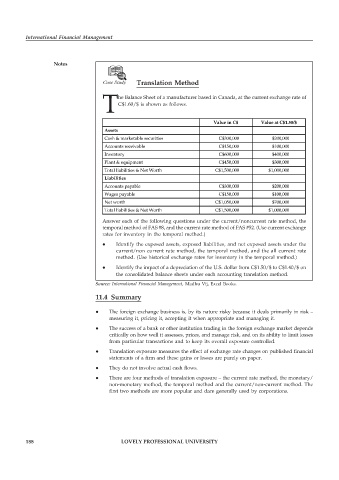

Case Study Translation Method

T he Balance Sheet of a manufacturer based in Canada, at the current exchange rate of

C$1.60/$ is shown as follows.

Value in C$ Value at C$1.50/$

Assets

Cash & marketable securities C$300,000 $200,000

Accounts receivable C$150,000 $100,000

Inventory C$600,000 $400,000

Plant & equipment C$450,000 $300,000

Total liabilities & Net Worth C$1,500,000 $1,000,000

Liabilities

Accounts payable C$300,000 $200,000

Wages payable C$150,000 $100,000

Net worth C$1,050,000 $700,000

Total liabilities & Net Worth C$1,500,000 $1,000,000

Answer each of the following questions under the current/noncurrent rate method, the

temporal method of FAS #8, and the current rate method of FAS #52. (Use current exchange

rates for inventory in the temporal method.)

Identify the exposed assets, exposed liabilities, and net exposed assets under the

current/non current rate method, the temporal method, and the all current rate

method. (Use historical exchange rates for inventory in the temporal method.)

Identify the impact of a depreciation of the U.S. dollar from C$1.50/$ to C$1.40/$ on

the consolidated balance sheets under each accounting translation method.

Source: International Financial Management, Madhu Vij, Excel Books.

11.4 Summary

The foreign exchange business is, by its nature risky because it deals primarily in risk –

measuring it, pricing it, accepting it when appropriate and managing it.

The success of a bank or other institution trading in the foreign exchange market depends

critically on how well it assesses, prices, and manage risk, and on its ability to limit losses

from particular transactions and to keep its overall exposure controlled.

Translation exposure measures the effect of exchange rate changes on published financial

statements of a firm and these gains or losses are purely on paper.

They do not involve actual cash flows.

There are four methods of translation exposure – the current rate method, the monetary/

non-monetary method, the temporal method and the current/non-current method. The

first two methods are more popular and dare generally used by corporations.

188 LOVELY PROFESSIONAL UNIVERSITY