Page 189 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 189

International Financial Management

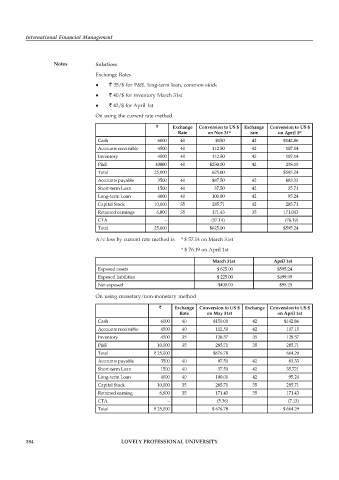

Notes Solution:

Exchange Rates

` 35/$ for P&E, long-term loan, common stock

` 40/$ for inventory March 31st

` 42/$ for April 1st

On using the current rate method

` Exchange Conversion to US $ Exchange Conversion to US $

Rate on Nov 31 rate on April 1

st

st

Cash 6000 40 $150 42 $142.86

Accounts receivable 4500 40 112.50 42 107.14

Inventory 4500 40 112.50 42 107.14

P&E 10000 40 $250.00 42 238.10

Total 25,000 625.00 $595.24

Accounts payable 3500 40 $87.50 42 $83.33

Short-term Loan 1500 40 37.50 42 35.71

Long-term Loan 4000 40 100.00 42 95.24

Capital Stock 10,000 35 285.71 42 285.71

Retained earnings 6,000 35 171.43 35 171.043

CTA – (57.14) (76.19)

Total 25,000 $625.00 $595.24

A/c loss by current rate method is * $ 57.14 on March 31st

* $ 76.19 on April 1st

March 31st April 1st

Exposed assets $ 625.00 $595.24

Exposed liabilities $ 225.00 $499.99

Net exposed $400.00 $95.25

On using monetary/non-monetary method

` Exchange Conversion to US $ Exchange Conversion to US $

Rate on May 31st on April 1st

Cash 6000 40 $150.00 42 $142.86

Accounts receivable 4500 40 112.50 42 107.15

Inventory 4500 35 128.57 35 128.57

P&E 10,000 35 285.71 35 285.71

Total ` 25,000 $676.78 664.29

Accounts payable 3500 40 87.50 42 83.33

Short-term Loan 1500 40 37.50 42 35.721

Long-term Loan 4000 40 100.00 42 95.24

Capital Stock 10,000 35 285.71 35 285.71

Retained earning 6,000 35 171.43 35 171.43

CTA – (5.36) (7.13)

Total ` 25,000 $ 676.78 $ 664.29

184 LOVELY PROFESSIONAL UNIVERSITY