Page 190 - DMGT549_INTERNATIONAL_FINANCIAL_MANAGEMENT

P. 190

Unit 11: Management of Translation Exposure

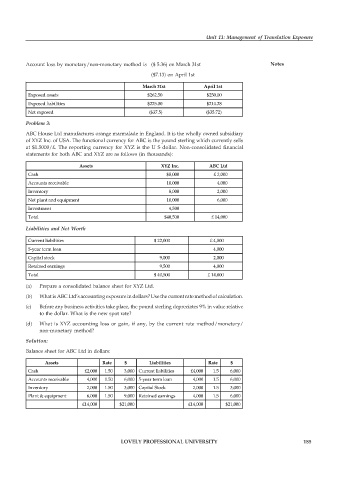

Account loss by monetary/non-monetary method is ($ 5.36) on March 31st Notes

($7.13) on April 1st

March 31st April 1st

Exposed assets $262.50 $250.00

Exposed liabilities $225.00 $214.28

Net exposed ($37.5) ($35.72)

Problem 3:

ABC House Ltd manufactures orange marmalade in England. It is the wholly owned subsidiary

of XYZ Inc. of USA. The functional currency for ABC is the pound sterling which currently sells

at $1.5000/£. The reporting currency for XYZ is the U S dollar. Non-consolidated financial

statements for both ABC and XYZ are as follows (in thousands):

Assets XYZ Inc. ABC Ltd

Cash $8,000 £ 2,000

Accounts receivable 10,000 4,000

Inventory 8,000 2,000

Net plant and equipment 10,000 6,000

Investment 4,500

Total $40,500 £ 14,000

Liabilities and Net Worth

Current liabilities $ 22,000 £ 4,000

5-year term loan 4,000

Capital stock 9,000 2,000

Retained earnings 9,500 4,000

Total $ 40,500 £ 14,000

(a) Prepare a consolidated balance sheet for XYZ Ltd.

(b) What is ABC Ltd’s accounting exposure in dollars? Use the current rate method of calculation.

(c) Before any business activities take place, the pound sterling depreciates 9% in value relative

to the dollar. What is the new spot rate?

(d) What is XYZ accounting loss or gain, if any, by the current rate method/monetary/

non-monetary method?

Solution:

Balance sheet for ABC Ltd in dollars:

Assets Rate $ Liabilities Rate $

Cash £2,000 1.50 3,000 Current liabilities £4,000 1.5 6,000

Accounts receivable 4,000 1.50 6,000 5-year term loan 4,000 1.5 6,000

Inventory 2,000 1.50 3,000 Capital Stock 2,000 1.5 3,000

Plant & equipment 6,000 1.50 9,000 Retained earnings 4,000 1.5 6,000

£14,000 $21,000 £14,000 $21,000

LOVELY PROFESSIONAL UNIVERSITY 185