Page 120 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 120

Unit 5: Redemption of Preference Shares

Notes

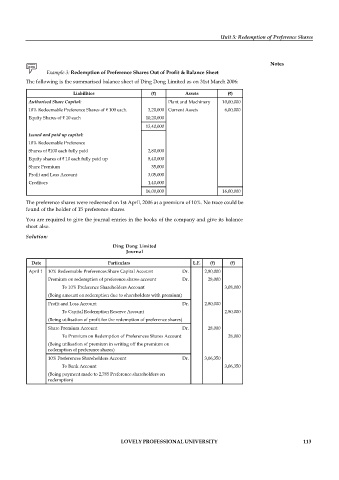

Example 3: Redemption of Preference Shares Out of Profit & Balance Sheet

The following is the summarised balance sheet of Ding Dong Limited as on 31st March 2006:

Liabilities ( ) Assets ( )

Authorised Share Capital: Plant and Machinery 10,00,000

10% Redeemable Preference Shares of 100 each. 3,20,000 Current Assets 6,00,000

Equity Shares of 10 each 10,20,000

13,40,000

Issued and paid up capital:

10% Redeemable Preference

Shares of 100 each fully paid 2,80,000

Equity shares of 10 each fully paid up 8,40,000

Share Premium 35,000

Profit and Loss Account 3,05,000

Creditors 1,40,000

16,00,000 16,00,000

The preference shares were redeemed on 1st April, 2006 at a premium of 10%. No trace could be

found of the holder of 15 preference shares.

You are required to give the journal entries in the books of the company and give its balance

sheet also.

Solution:

Ding Dong Limited

Journal

Date Particulars L.F. ( ) ( )

April 1 10% Redeemable Preferences Share Capital Account Dr. 2,80,000

Premium on redemption of preference shares account Dr. 28,000

To 10% Preference Shareholders Account 3,08,000

(Being amount on redemption due to shareholders with premium)

Profit and Loss Account Dr. 2,80,000

To Capital Redemption Reserve Account 2,80,000

(Being utilisation of profit for the redemption of preference shares)

Share Premium Account Dr. 28,000

To Premium on Redemption of Preferences Shares Account 28,000

(Being utilisation of premium in writing off the premium on

redemption of preference shares)

10% Preferences Shareholders Account Dr. 3,06,350

To Bank Account 3,06,350

(Being payment made to 2,785 Preference shareholders on

redemption)

LOVELY PROFESSIONAL UNIVERSITY 113