Page 211 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 211

Particulars

2004

Jan. 1

Dr.

1,25,000

Dr.

Discount on Issue of Debentures A/c

To 12% Debentures Account

(Being issue of 12% debentures at discount)

Dec. 31 Profit and Loss account

25,000

Dr.

25,000

To Discount on Issue of Debentures Account

(Being discount on debentures written off from P & L account)

2005

20,000

Dec. 31 12% Debentures Account

Dr.

18,000

To Bank Account

To Profit on Redemption of Debentures Account

2,000

(Being cancellation of 40 debentures by purchasing them

@ 450 per debenture)

2,000

Dr.

Profit on Redemption of Debenture Account

2,000

To Capital Reserve Account

Date Bank Account L.F. 23,75,000 25,00,000

(Being profit on redemption of debentures transferred to capital

reserve account)

12% Debentures Account Dr. 30,000

To Bank Account 24,000

To Profit on Redemption of Debentures Account 6,000

Accounting for Companies-I (Being cancellation of 60 debentures)

Profit on Redemption of Debenture Account Dr. 6,000

To Capital Reserve Account 6,000

(Being transfer of profit on cancellation of debentures)

Notes Own Debentures Account Dr. 8,000

To Bank Account 8,000

(Being own debenture purchased as own debentures

(38,000 – 30,000)

Profit & Loss Account Dr. 50,000

To General Reserve Account 50,000

(An equal amount to nominal value of debentures redeemed

transferred to general reserve)

Profit and Loss Account Dr. 20,000

To Discount on Issue of Debentures Account 20,000

(Being discount on issue of debentures written off against profits)

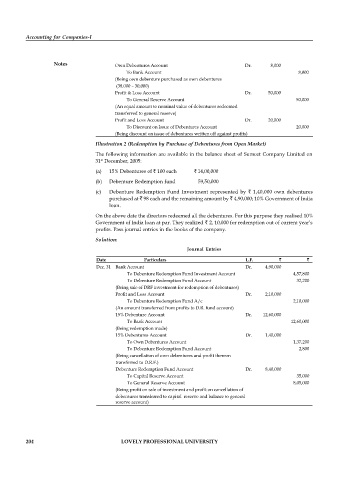

Illustration 2 (Redemption by Purchase of Debentures from Open Market)

The following information are available in the balance sheet of Sumeet Company Limited on

st

31 December, 2005:

(a) 15% Debentures of 100 each 14,00,000

(b) Debenture Redemption fund 59,50,000

(c) Debenture Redemption Fund Investment represented by 1,40,000 own debentures

purchased at 98 each and the remaining amount by 4,90,000; 10% Government of India

loan.

On the above date the directors redeemed all the debentures. For this purpose they realised 10%

Government of India loan at par. They realized 2, 10,000 for redemption out of current year’s

profits. Pass journal entries in the books of the company.

Solution:

Journal Entries

Date Particulars L.F.

Dec. 31 Bank Account Dr. 4,90,000

To Debenture Redemption Fund Investment Account 4,57,800

To Debenture Redemption Fund Account 32,200

(Being sale of DRF investment for redemption of debentures)

Profit and Loss Account Dr. 2,10,000

To Debenture Redemption Fund A/c 2,10,000

(An amount transferred from profits to D.R. fund account)

15% Debenture Account Dr. 12,60,000

To Bank Account 12,60,000

(Being redemption made)

15% Debentures Account Dr. 1,40,000

To Own Debentures Account 1,37,200

To Debenture Redemption Fund Account 2,800

(Being cancellation of own debentures and profit thereon

transferred to D.R.F.)

Debenture Redemption Fund Account Dr. 8,40,000

To Capital Reserve Account 35,000

To General Reserve Account 8,05,000

(Being profit on sale of investment and profit on cancellation of

debentures transferred to capital reserve and balance to general

reserve account)

204 LOVELY PROFESSIONAL UNIVERSITY