Page 213 - DCOM201_ACCOUNTING_FOR_COMPANIES_I

P. 213

Accounting for Companies-I

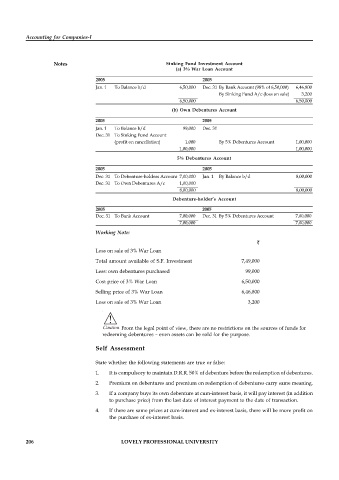

Notes Sinking Fund Investment Account

(a) 3% War Loan Account

2005 2005

Jan. 1 To Balance b/d 6,50,000 Dec. 31 By Bank Account (98% of 6,50,000) 6,46,800

By Sinking Fund A/c (loss on sale) 3,200

6,50,000 6,50,000

(b) Own Debentures Account

2005 2005

Jan. 1 To Balance b/d 99,000 Dec. 31

Dec. 31 To Sinking Fund Account

(profit on cancellation) 1,000 By 5% Debentures Account 1,00,000

1,00,000 1,00,000

5% Debentures Account

2005 2005

Dec. 31 To Debenture-holders Account 7,00,000 Jan. 1 By Balance b/d 8,00,000

Dec. 31 To Own Debentures A/c 1,00,000

8,00,000 8,00,000

Debenture-holder’s Account

2005 2005

Dec. 31 To Bank Account 7,00,000 Dec. 31 By 5% Debentures Account 7,00,000

7,00,000 7,00,000

Working Note:

`

Loss on sale of 3% War Loan

Total amount available of S.F. Investment 7,49,000

Less: own debentures purchased 99,000

Cost price of 3% War Loan 6,50,000

Selling price of 3% War Loan 6,46,800

Loss on sale of 3% War Loan 3,200

!

Caution From the legal point of view, there are no restrictions on the sources of funds for

redeeming debentures – even assets can be sold for the purpose.

Self Assessment

State whether the following statements are true or false:

1. It is compulsory to maintain D.R.R. 50% of debenture before the redemption of debentures.

2. Premium on debentures and premium on redemption of debentures carry same meaning.

3. If a company buys its own debenture at cum-interest basis, it will pay interest (in addition

to purchase price) from the last date of interest payment to the date of transaction.

4. If there are same prices at cum-interest and ex-interest basis, there will be more profit on

the purchase of ex-interest basis.

206 LOVELY PROFESSIONAL UNIVERSITY