Page 120 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 120

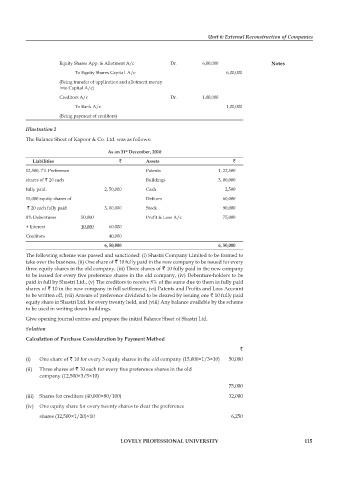

Unit 6: External Reconstruction of Companies

Equity Shares App. & Allotment A/c Dr. 6,00,000 notes

To Equity Shares Capital A/c 6,00,000

(Being transfer of application and allotment money

into Capital A/c)

Creditors A/c Dr. 1,00,000

To Bank A/c 1,00,000

(Being payment of creditors)

Illustration 2

The Balance Sheet of Kapoor & Co. Ltd. was as follows:

as on 31 December, 2010

st

liabilities ` assets `

12,500, 7% Preference Patents 1, 22,500

shares of ` 20 each Buildings 3, 00,000

fully paid. 2, 50,000 Cash 2,500

15,000 equity shares of Debtors 60,000

` 20 each fully paid 3, 00,000 Stock 90,000

8% Debentures 50,000 Profit & Loss A/c 75,000

+ Interest 10,000 60,000

Creditors 40,000

6, 50,000 6, 50,000

The following scheme was passed and sanctioned: (i) Shastri Company Limited to be formed to

take over the business, (ii) One share of ` 10 fully paid in the new company to be issued for every

three equity shares in the old company, (iii) Three shares of ` 10 fully paid in the new company

to be issued for every five preference shares in the old company, (iv) Debenture-holders to be

paid in full by Shastri Ltd., (v) The creditors to receive 8% of the sums due to them in fully paid

shares of ` 10 in the new company in full settlement, (vi) Patents and Profits and Loss Account

to be written off, (vii) Arrears of preference dividend to be cleared by issuing one ` 10 fully paid

equity share in Shastri Ltd. for every twenty held, and (viii) Any balance available by the scheme

to be used in writing down buildings.

Give opening journal entries and prepare the initial Balance Sheet of Shastri Ltd.

Solution

calculation of purchase consideration by payment method

`

(i) One share of ` 10 for every 3 equity shares in the old company (15,000×1/3×10) 50,000

(ii) Three shares of ` 10 each for every five preference shares in the old

company (12,500×3/5×10)

75,000

(iii) Shares for creditors (40,000×80/100) 32,000

(iv) One equity share for every twenty shares to clear the preference

shares (12,500×1/20)×10 6,250

lovely professional university 115