Page 125 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 125

Accounting for Companies – II

notes Solution

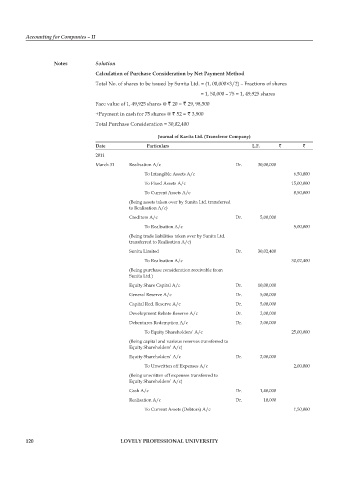

calculation of purchase consideration by net payment method

Total No. of shares to be issued by Sunita Ltd. = (1, 00,000×3/2) – Fractions of shares

= 1, 50,000 – 75 = 1, 49,925 shares

Face value of 1, 49,925 shares @ ` 20 = ` 29, 98,500

+Payment in cash for 75 shares @ ` 52 = ` 3,900

Total Purchase Consideration = 30,02,400

Journal of kavita ltd. (transferor company)

Date particulars l.f. ` `

2011

March 31 Realisation A/c Dr. 30,00,000

To Intangible Assets A/c 6,50,000

To Fixed Assets A/c 15,00,000

To Current Assets A/c 8,50,000

(Being assets taken over by Sunita Ltd. transferred

to Realisation A/c)

Creditors A/c Dr. 5,00,000

To Realisation A/c 5,00,000

(Being trade liabilities taken over by Sunita Ltd.

transferred to Realisation A/c)

Sunita Limited Dr. 30,02,400

To Realisation A/c 30,02,400

(Being purchase consideration receivable from

Sunita Ltd.)

Equity Share Capital A/c Dr. 10,00,000

General Reserve A/c Dr. 5,00,000

Capital Red. Reserve A/c Dr. 5,00,000

Development Rebate Reserve A/c Dr. 2,00,000

Debentures Redemption A/c Dr. 3,00,000

To Equity Shareholders’ A/c 25,00,000

(Being capital and various reserves transferred to

Equity Shareholders’ A/c)

Equity Shareholders’ A/c Dr. 2,00,000

To Unwritten off Expenses A/c 2,00,000

(Being unwritten off expenses transferred to

Equity Shareholders’ A/c)

Cash A/c Dr. 1,40,000

Realisation A/c Dr. 10,000

To Current Assets (Debtors) A/c 1,50,000

120 lovely professional university