Page 126 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 126

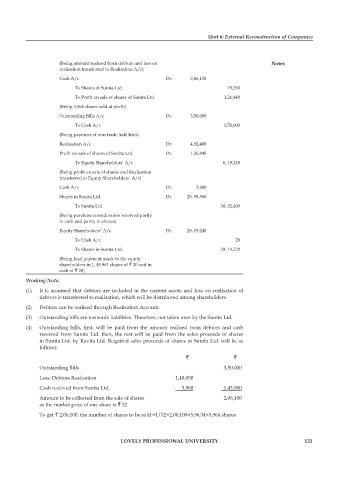

Unit 6: External Reconstruction of Companies

(Being amount realised from debtors and loss on notes

realisation transferred to Realisation A/c)

Cash A/c Dr. 2,06,128

To Shares of Sunita Ltd. 79,280

To Profit on sale of shares of Sunita Ltd. 1,26,848

(Being 3,964 shares sold at profit)

Outstanding Bills A/c Dr. 3,50,000

To Cash A/c 3,50,000

(Being payment of non-trade liabilities)

Realisation A/c Dr. 4,92,400

Profit on sale of shares of Sunita Ltd. Dr. 1,26,848

To Equity Shareholders’ A/c 6, 19,248

(Being profit on sale of shares and Realisation

transferred to Equity Shareholders’ A/c)

Cash A/c Dr. 3,900

Shares in Sunita Ltd. Dr. 29, 98,500

To Sunita Ltd. 30, 02,400

(Being purchase consideration received partly

in cash and partly in shares)

Equity Shareholders’ A/c Dr. 29, 19,248

To Cash A/c 28

To Shares in Sunita Ltd. 29, 19,220

(Being final payment made to the equity

shareholders in 1, 45,961 shares of ` 20 and in

cash of ` 28)

Working Note:

(1) It is assumed that debtors are included in the current assets and loss on realisation of

debtors is transferred to realisation, which will be distributed among shareholders.

(2) Debtors can be realised through Realisation Account.

(3) Outstanding bills are not trade liabilities. Therefore, not taken over by the Sunita Ltd.

(4) Outstanding bills, first, will be paid from the amount realised from debtors and cash

received from Sunita Ltd. then, the rest will be paid from the sales proceeds of shares

in Sunita Ltd. by Kavita Ltd. Required sales proceeds of shares in Sunita Ltd. will be as

follows:

` `

Outstanding Bills 3,50,000

Less: Debtors Realisation 1,40,000

Cash received from Sunita Ltd. 3,900 1,43,900

Amount to be collected from the sale of shares 2,06,100

as the market price of one share is ` 52

To get ` 2,06,100, the number of shares to be sold =1/52×2,06,100=3,96,34=3,964 shares

lovely professional university 121