Page 127 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 127

Accounting for Companies – II

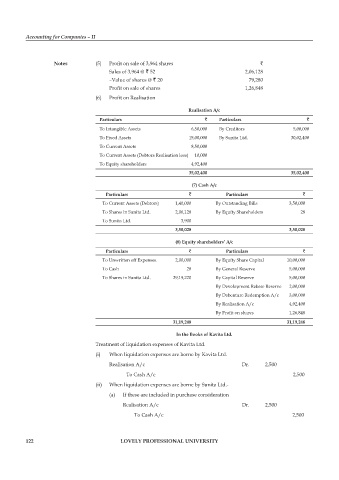

notes (5) Profit on sale of 3,964 shares `

Sales of 3,964 @ ` 52 2,06,128

–Value of shares @ ` 20 79,280

Profit on sale of shares 1,26,848

(6) Profit on Realisation

realisation a/c

particulars ` particulars `

To Intangible Assets 6,50,000 By Creditors 5,00,000

To Fixed Assets 15,00,000 By Sunita Ltd. 30,02,400

To Current Assets 8,50,000

To Current Assets (Debtors Realisation loss) 10,000

To Equity shareholders 4,92,400

35,02,400 35,02,400

(7) cash a/c

particulars ` particulars `

To Current Assets (Debtors) 1,40,000 By Outstanding Bills 3,50,000

To Shares in Sunita Ltd. 2,06,128 By Equity Shareholders 28

To Sunita Ltd. 3,900

3,50,028 3,50,028

(8) equity shareholders’ a/c

particulars ` particulars `

To Unwritten off Expenses. 2,00,000 By Equity Share Capital 10,00,000

To Cash 28 By General Reserve 5,00,000

To Shares in Sunita Ltd. 29,19,220 By Capital Reserve 5,00,000

By Development Rebate Reserve 2,00,000

By Debenture Redemption A/c 3,00,000

By Realisation A/c 4,92,400

By Profit on shares 1,26,848

31,19,248 31,19,248

in the Books of kavita ltd.

Treatment of liquidation expenses of Kavita Ltd.

(i) When liquidation expenses are borne by Kavita Ltd.

Realisation A/c Dr. 2,500

To Cash A/c 2,500

(ii) When liquidation expenses are borne by Sunita Ltd.-

(a) If these are included in purchase consideration

Realisation A/c Dr. 2,500

To Cash A/c 2,500

122 lovely professional university