Page 122 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 122

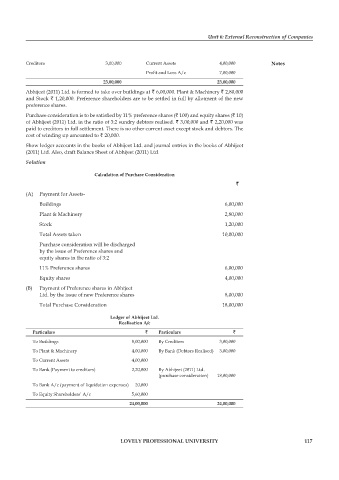

Unit 6: External Reconstruction of Companies

Creditors 3,00,000 Current Assets 4,00,000 notes

Profit and Loss A/c 7,00,000

23,00,000 23,00,000

Abhijeet (2011) Ltd. is formed to take over buildings at ` 6,00,000. Plant & Machinery ` 2,80,000

and Stock ` 1,20,000. Preference shareholders are to be settled in full by allotment of the new

preference shares.

Purchase consideration is to be satisfied by 11% preference shares (` 100) and equity shares (` 10)

of Abhijeet (2011) Ltd. in the ratio of 3:2 sundry debtors realised. ` 3,00,000 and ` 2,20,000 was

paid to creditors in full settlement. There is no other current asset except stock and debtors. The

cost of winding up amounted to ` 20,000.

Show ledger accounts in the books of Abhijeet Ltd. and journal entries in the books of Abhijeet

(2011) Ltd. Also, draft Balance Sheet of Abhijeet (2011) Ltd.

Solution

calculation of purchase consideration

`

(A) Payment for Assets-

Buildings 6,00,000

Plant & Machinery 2,80,000

Stock 1,20,000

Total Assets taken 10,00,000

Purchase consideration will be discharged

by the issue of Preference shares and

equity shares in the ratio of 3:2

11% Preference shares 6,00,000

Equity shares 4,00,000

(B) Payment of Preference shares in Abhijeet

Ltd. by the issue of new Preference shares 8,00,000

Total Purchase Consideration 18,00,000

ledger of abhijeet ltd.

realisation a/c

particulars ` particulars `

To Buildings 8,00,000 By Creditors 3,00,000

To Plant & Machinery 4,00,000 By Bank (Debtors Realised) 3,00,000

To Current Assets 4,00,000

To Bank (Payment to creditors) 2,20,000 By Abhijeet (2011) Ltd.

(purchase consideration) 18,00,000

To Bank A/c (payment of liquidation expenses) 20,000

To Equity Shareholders’ A/c 5,60,000

24,00,000 24,00,000

lovely professional university 117