Page 126 - DCOM206_COST_ACCOUNTING_II

P. 126

Unit 6: Budgetary Control

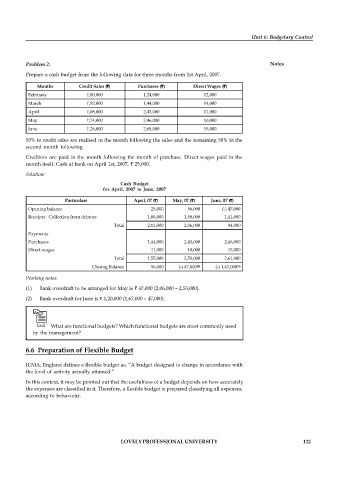

Problem 2: Notes

Prepare a cash budget from the following data for three months from 1st April, 2007.

Months Credit Sales (`) Purchases (`) Direct Wages (`)

February 1,80,000 1,24,800 12,000

March 1,92,000 1,44,000 14,000

April 1,08,000 2,43,000 11,000

May 1,74,000 2,46,000 10,000

June 1,26,000 2,68,000 15,000

50% to credit sales are realised in the month following the sales and the remaining 50% in the

second month following.

Creditors are paid in the month following the month of purchase. Direct wages paid in the

month itself. Cash at bank on April 1st, 2007, ` 25,000.

Solution:

Cash Budget

for April, 2007 to June, 2007

Particulars April, 07 (`) May, 07 (`) June, 07 (`)

Opening balance 25,000 56,000 (-) 47,000

Receipts : Collection from debtors 1,86,000 1,50,000 1,41,000

Total 2,11,000 2,06,000 94,000

Payments :

Purchases 1,44,000 2,43,000 2,46,000

Direct wages 11,000 10,000 15,000

Total 1,55,000 2,53,000 2,61,000

Closing Balance 56,000 (-) 47,000 (-) 1,67,000

(1)

(2)

Working notes:

(1) Bank overdraft to be arranged for May is ` 47,000 (2,06,000 – 2,53,000).

(2) Bank overdraft for June is ` 1,20,000 (1,67,000 – 47,000).

Task What are functional budgets? Which functional budgets are most commonly used

by the management?

6.6 Preparation of Flexible Budget

ICMA, England defines a flexible budget as, “A budget designed to change in accordance with

the level of activity actually attained.”

In this context, it may be pointed out that the usefulness of a budget depends on how accurately

the expenses are classified in it. Therefore, a flexible budget is prepared classifying all expenses,

according to behaviour.

LOVELY PROFESSIONAL UNIVERSITY 121