Page 250 - DCOM206_COST_ACCOUNTING_II

P. 250

Unit 13: Activity-based Costing

Notes

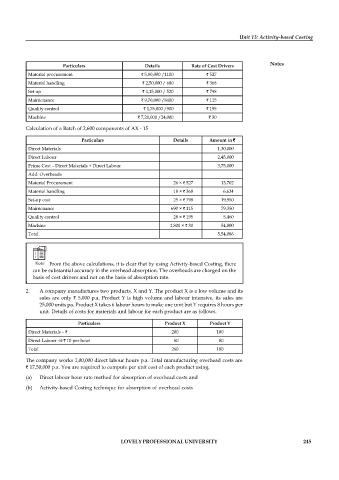

Particulars Details Rate of Cost Drivers

Material procurement ` 5,80,000 /1100 ` 527

Material handling ` 2,50,000 / 680 ` 368

Set up ` 4,15,000 / 520 ` 798

Maintenance ` 9,70,000 /8400 ` 115

Quality control ` 1,76,000 /900 ` 195

Machine ` 7,20,000 /24,000 ` 30

Calculation of a Batch of 2,600 components of AX - 15

Particulars Details Amount in `

Direct Materials 1,30,000

Direct Labour 2,45,000

Prime Cost – Direct Materials + Direct Labour 3,75,000

Add: Overheads

Material Procurement 26 × ` 527 13,702

Material handling 18 × ` 368 6,624

Set-up cost 25 × ` 798 19,950

Maintenance 690 × ` 115 79,350

Quality control 28 × ` 195 5,460

Machine 1,800 × ` 30 54,000

Total 5,54,086

Note From the above calculations, it is clear that by using Activity-based Costing, there

can be substantial accuracy in the overhead absorption. The overheads are charged on the

basis of cost drivers and not on the basis of absorption rate.

2. A company manufactures two products, X and Y. The product X is a low volume and its

sales are only ` 5,000 p.a. Product Y is high volume and labour intensive, its sales are

25,000 units pa. Product X takes 6 labour hours to make one unit but Y requires 8 hours per

unit. Details of costs for materials and labour for each product are as follows.

Particulars Product X Product Y

Direct Materials – ` 200 100

Direct Labour -@ ` 10 per hour 60 80

Total 260 180

The company works 1,00,000 direct labour hours p.a. Total manufacturing overhead costs are

` 17,50,000 p.a. You are required to compute per unit cost of each product using,

(a) Direct labour hour rate method for absorption of overhead costs and

(b) Activity-based Costing technique for absorption of overhead costs

LOVELY PROFESSIONAL UNIVERSITY 245