Page 251 - DCOM206_COST_ACCOUNTING_II

P. 251

Cost Accounting – II

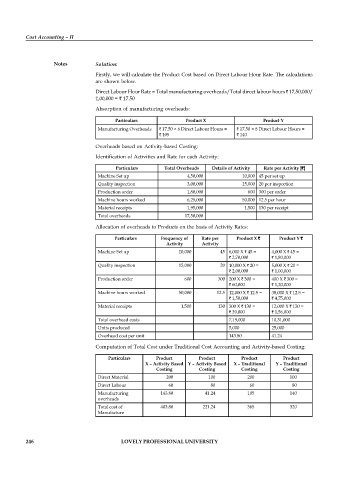

Notes Solution:

Firstly, we will calculate the Product Cost based on Direct Labour Hour Rate. The calculations

are shown below.

Direct Labour Hour Rate = Total manufacturing overheads/Total direct labour hours ` 17,50,000/

1,00,000 = ` 17.50

Absorption of manufacturing overheads:

Particulars Product X Product Y

Manufacturing Overheads ` 17.50 × 6 Direct Labour Hours = ` 17.50 × 8 Direct Labour Hours =

` 105 ` 140

Overheads based on Activity-based Costing:

Identification of Activities and Rate for each Activity:

Particulars Total Overheads Details of Activity Rate per Activity [`]

Machine Set up 4,50,000 10,000 45 per set up

Quality inspection 3,00,000 15,000 20 per inspection

Production order 1,80,000 600 300 per order

Machine hours worked 6,25,000 50,000 12.5 per hour

Material receipts 1,95,000 1,500 130 per receipt

Total overheads 17,50,000

Allocation of overheads to Products on the basis of Activity Rates:

Particulars Frequency of Rate per Product X ` Product Y `

Activity Activity

Machine Set up 10,000 45 6,000 X ` 45 = 4,000 X ` 45 =

` 2,70,000 ` 1,80,000

Quality inspection 15,000 20 10,000 X ` 20 = 5,000 X ` 20 =

` 2,00,000 ` 1,00,000

Production order 600 300 200 X ` 300 = 400 X ` 300 =

` 60,000 ` 1,20,000

Machine hours worked 50,000 12.5 12,000 X ` 12.5 = 38,000 X ` 12.5 =

` 1,50,000 ` 4,75,000

Material receipts 1,500 130 300 X ` 130 = 12,000 X ` 130 =

` 39,000 ` 1,56,000

Total overhead costs 7,19,000 10,31,000

Units produced 5,000 25,000

Overhead cost per unit 143.80 41.24

Computation of Total Cost under Traditional Cost Accounting and Activity-based Costing:

Particulars Product Product Product Product

X – Activity Based Y – Activity Based X – Traditional Y – Traditional

Costing Costing Costing Costing

Direct Material 200 100 200 100

Direct Labour 60 80 60 80

Manufacturing 143.80 41.24 105 140

overheads

Total cost of 403.80 221.24 365 320

Manufacture

246 LOVELY PROFESSIONAL UNIVERSITY