Page 252 - DCOM206_COST_ACCOUNTING_II

P. 252

Unit 13: Activity-based Costing

From the above comparative analysis it is clear that, under Traditional Costing, Product X is Notes

charged with ` 105 per unit as manufacturing overheads while in case of Product Y, the share of

overhead cost is ` 140. Under Activity-based Costing the amount is ` 143.80 and ` 41.24 per unit.

Thus due to Activity-based Costing, the distortion in cost is avoided.

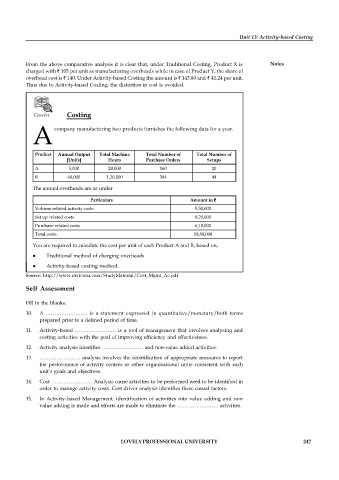

Caselet Costing

A company manufacturing two products furnishes the following data for a year.

Product Annual Output Total Machine Total Number of Total Number of

[Units] Hours Purchase Orders Setups

A 5,000 20,000 160 20

B 60,000 1,20,000 384 44

The annual overheads are as under

Particulars Amount in `

Volume related activity costs 5,50,000

Set up related costs 8,20,000

Purchase related costs 6,18,000

Total costs 19,88,000

You are required to calculate the cost per unit of each Product A and B, based on,

Traditional method of charging overheads

Activity-based costing method.

Source: http://www.myicwai.com/StudyMaterial/Cost_Mgmt_Ac.pdf

Self Assessment

Fill in the blanks:

10. A …………………… is a statement expressed in quantitative/monetary/both terms

prepared prior to a defined period of time.

11. Activity-based …………………… is a tool of management that involves analysing and

costing activities with the goal of improving efficiency and effectiveness.

12. Activity analysis identifies …………………… and non-value added activities.

13. …………………… analysis involves the identification of appropriate measures to report

the performance of activity centres or other organisational units consistent with each

unit’s goals and objectives.

14. Cost …………………… Analysis cause activities to be performed need to be identified in

order to manage activity costs. Cost driver analysis identifies these casual factors.

15. In Activity-based Management, identification of activities into value adding and non

value adding is made and efforts are made to eliminate the …………………… activities.

LOVELY PROFESSIONAL UNIVERSITY 247