Page 185 - DMGT405_FINANCIAL%20MANAGEMENT

P. 185

Unit 9: Capital Budgeting

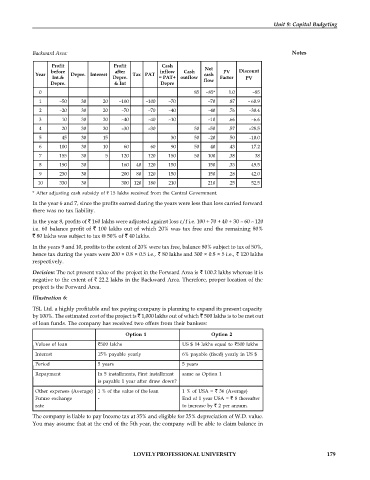

Backward Area: Notes

Profit Profit Cash

before after inflow Cash Net PV Discount

Year Depre. Interest Tax PAT cash

Int.& Depre. = PAT+ outflow Factor PV

Depre. & Int Depre flow

0 85 –85* 1.0 –85

1 –50 30 20 –100 –100 –70 –70 .87 – 60.9

2 –20 30 20 –70 –70 –40 –40 .76 –30.4

3 10 30 20 –40 –40 –10 –10 .66 –6.6

4 20 30 20 –30 –30 50 –50 .57 –28.5

5 45 30 15 30 50 –20 .50 –10.0

6 100 30 10 60 60 90 50 40 .43 17.2

7 155 30 5 120 120 150 50 100 .38 38

8 190 30 160 40 120 150 150 .33 49.5

9 230 30 200 80 120 150 150 .28 42.0

10 330 30 300 120 180 210 210 .25 52.5

* After adjusting cash subsidy of 15 lakhs received from the Central Government.

In the year 6 and 7, since the profits earned during the years were less than loss carried forward

there was no tax liability.

In the year 8, profits of 160 lakhs were adjusted against loss c/f i.e. 100 + 70 + 40 + 30 – 60 – 120

i.e. 60 balance profit of 100 lakhs out of which 20% was tax free and the remaining 80%

80 lakhs was subject to tax @ 50% of 40 lakhs.

In the years 9 and 10, profits to the extent of 20% were tax free, balance 80% subject to tax of 50%,

hence tax during the years were 200 × 0.8 × 0.5 i.e., 80 lakhs and 300 × 0.8 × 5 i.e., 120 lakhs

respectively.

Decision: The net present value of the project in the Forward Area is 100.2 lakhs whereas it is

negative to the extent of 22.2 lakhs in the Backward Area. Therefore, proper location of the

project is the Forward Area.

Illustration 6:

TSL Ltd. a highly profitable and tax paying company is planning to expand its present capacity

by 100%. The estimated cost of the project is 1,000 lakhs out of which 500 lakhs is to be met out

of loan funds. The company has received two offers from their bankers:

Option 1 Option 2

Values of loan 500 lakhs US $ 14 lakhs equal to 500 lakhs

Interest 15% payable yearly 6% payable (fixed) yearly in US $

Period 5 years 5 years

Repayment In 5 installments, First installment same as Option 1

is payable 1 year after draw down?

Other expenses (Average) 1 % of the value of the loan 1 % of USA = 36 (Average)

Future exchange - End of 1 year USA = 8 thereafter

rate to increase by 2 per annum.

The company is liable to pay Income tax at 35% and eligible for 25% depreciation of W.D. value.

You may assume that at the end of the 5th year, the company will be able to claim balance in

LOVELY PROFESSIONAL UNIVERSITY 179