Page 189 - DMGT405_FINANCIAL%20MANAGEMENT

P. 189

Unit 9: Capital Budgeting

Notes

!

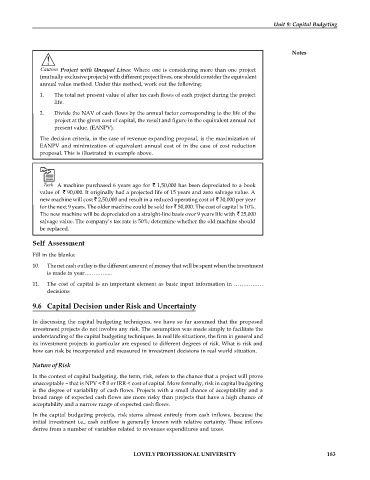

Caution Project with Unequal Lives: Where one is considering more than one project

(mutually exclusive projects) with different project lives, one should consider the equivalent

annual value method. Under this method, work out the following:

1. The total net present value of after tax cash flows of each project during the project

life.

2. Divide the NAV of cash flows by the annual factor corresponding to the life of the

project at the given cost of capital, the result and figure in the equivalent annual net

present value. (EANPV).

The decision criteria, in the case of revenue expanding proposal, is the maximization of

EANPV and minimization of equivalent annual cost of in the case of cost reduction

proposal. This is illustrated in example above.

Task A machine purchased 6 years ago for 1,50,000 has been depreciated to a book

value of 90,000. It originally had a projected life of 15 years and zero salvage value. A

new machine will cost 2,50,000 and result in a reduced operating cost of 30,000 per year

for the next 9 years. The older machine could be sold for 50,000. The cost of capital is 10%.

The new machine will be depreciated on a straight-line basis over 9 years life with 25,000

salvage value. The company’s tax rate is 50%; determine whether the old machine should

be replaced.

Self Assessment

Fill in the blanks:

10. The net cash outlay is the different amount of money that will be spent when the investment

is made in year…………....

11. The cost of capital is an important element as basic input information in …………….

decisions

9.6 Capital Decision under Risk and Uncertainty

In discussing the capital budgeting techniques, we have so far assumed that the proposed

investment projects do not involve any risk. The assumption was made simply to facilitate the

understanding of the capital budgeting techniques. In real life situations, the firm in general and

its investment projects in particular are exposed to different degrees of risk. What is risk and

how can risk be incorporated and measured in investment decisions in real world situation.

Nature of Risk

In the context of capital budgeting, the term, risk, refers to the chance that a project will prove

unacceptable – that is NPV < 0 or IRR < cost of capital. More formally, risk in capital budgeting

is the degree of variability of cash flows. Projects with a small chance of acceptability and a

broad range of expected cash flows are more risky than projects that have a high chance of

acceptability and a narrow range of expected cash flows.

In the capital budgeting projects, risk stems almost entirely from cash inflows, because the

initial investment i.e., cash outflow is generally known with relative certainty. These inflows

derive from a number of variables related to revenues expenditures and taxes.

LOVELY PROFESSIONAL UNIVERSITY 183