Page 9 - DCOM505_WORKING_CAPITAL_MANAGEMENT

P. 9

Working Capital Management

Notes

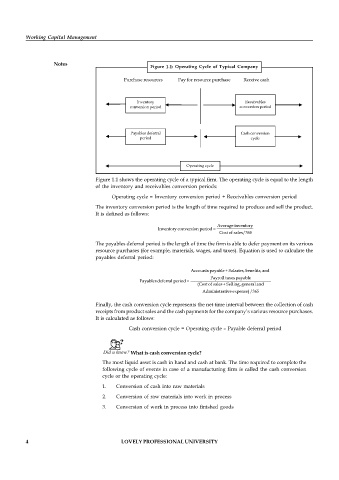

Figure 1.1: Operating Cycle of Typical Company

Purchase resources Pay for resource purchase Receive cash

Inventory Receivables

conversion period conversion period

Payables deferral Cash conversion

period cycle

Operating cycle

Figure 1.1 shows the operating cycle of a typical firm. The operating cycle is equal to the length

of the inventory and receivables conversion periods:

Operating cycle = Inventory conversion period + Receivables conversion period

The inventory conversion period is the length of time required to produce and sell the product.

It is defined as follows:

Average inventory

Inventory conversion period =

Cost of sales/365

The payables deferral period is the length of time the firm is able to defer payment on its various

resource purchases (for example, materials, wages, and taxes). Equation is used to calculate the

payables deferral period:

Accounts payable + Salaries, benefits, and

Payroll taxes payable

Payables deferral period =

(Cost of sales + Selling, general and

Administrative expense) /365

Finally, the cash conversion cycle represents the net time interval between the collection of cash

receipts from product sales and the cash payments for the company’s various resource purchases.

It is calculated as follows:

Cash conversion cycle = Operating cycle – Payable deferral period

Did u know? What is cash conversion cycle?

The most liquid asset is cash in hand and cash at bank. The time required to complete the

following cycle of events in case of a manufacturing firm is called the cash conversion

cycle or the operating cycle:

1. Conversion of cash into raw materials

2. Conversion of raw materials into work in process

3. Conversion of work in process into finished goods

4 LOVELY PROFESSIONAL UNIVERSITY