Page 197 - DMGT403_ACCOUNTING_FOR_MANAGERS

P. 197

Accounting for Managers

Notes

Example: 1. Sales commission

2. Agents commission

3. Carriage outward expenses.

The sales overhead budget is the statement of estimates of the various sales promotional expenses

not only based on the early/yester period sales promotional expenses but also on the sales of

previous years.

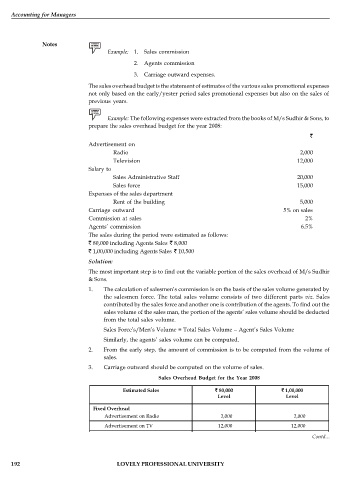

Example: The following expenses were extracted from the books of M/s Sudhir & Sons, to

prepare the sales overhead budget for the year 2008:

Advertisement on

Radio 2,000

Television 12,000

Salary to

Sales Administrative Staff 20,000

Sales force 15,000

Expenses of the sales department

Rent of the building 5,000

Carriage outward 5% on sales

Commission at sales 2%

Agents’ commission 6.5%

The sales during the period were estimated as follows:

80,000 including Agents Sales 8,000

1,00,000 including Agents Sales 10,500

Solution:

The most important step is to find out the variable portion of the sales overhead of M/s Sudhir

& Sons.

1. The calculation of salesmen’s commission is on the basis of the sales volume generated by

the salesmen force. The total sales volume consists of two different parts viz. Sales

contributed by the sales force and another one is contribution of the agents. To find out the

sales volume of the sales man, the portion of the agents’ sales volume should be deducted

from the total sales volume.

Sales Force’s/Men’s Volume = Total Sales Volume – Agent’s Sales Volume

Similarly, the agents’ sales volume can be computed.

2. From the early step, the amount of commission is to be computed from the volume of

sales.

3. Carriage outward should be computed on the volume of sales.

Sales Overhead Budget for the Year 2008

Estimated Sales 80,000 1,00,000

Level Level

Fixed Overhead

Advertisement on Radio 2,000 2,000

Advertisement on TV 12,000 12,000

Salary to Sales Admin. Staff 20,000 20,000 Contd...

Salary to Sales force 15,000 15,000

Expenses of the sales dept – Rent 5,000 5,000

LOVELY PROFESSIONAL UNIVERSITY

192 Total Sales Fixed Overhead (A) 54,000 54,000

Variable Overhead

Salesmen’s Commission 2% 1,440 10,290

Agents’ Commission 6.5% 520 682.5

Carriage outward 5% 4,000 5,000

Total Variable Overhead (B) 5,960 5682.5

Total Sales overhead(A+B) 59,960 59682.5