Page 18 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 18

Unit 1: Acquisition of Business

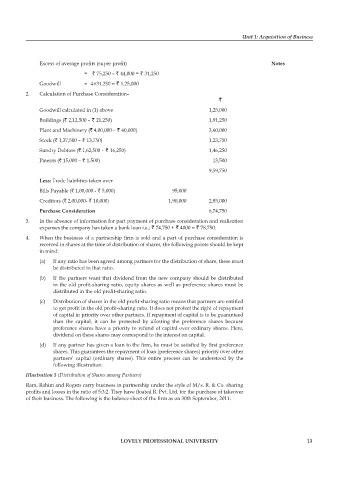

Excess of average profits (super profit) notes

= ` 75,250 – ` 44,000 = ` 31,250

Goodwill = 4×31,250 = ` 1,25,000

2. Calculation of Purchase Consideration–

`

Goodwill calculated in (1) above 1,25,000

Buildings (` 2,12,500 – ` 21,250) 1,91,250

Plant and Machinery (` 4,00,000 – ` 40,000) 3,60,000

Stock (` 1,37,500 – ` 13,750) 1,23,750

Sundry Debtors (` 1,62,500 – ` 16,250) 1,46,250

Patents (` 15,000 – ` 1,500) 13,500

9,59,750

less: Trade liabilities taken over

Bills Payable (` 1,00,000 - ` 5,000) 95,000

Creditors (` 2,00,000- ` 10,000) 1,90,000 2,85,000

purchase consideration 6,74,750

3. In the absence of information for part payment of purchase consideration and realisation

expenses the company has taken a bank loan i.e.; ` 74,750 + ` 4000 = ` 78,750.

4. When the business of a partnership firm is sold and a part of purchase consideration is

received in shares at the time of distribution of shares, the following points should be kept

in mind:

(a) If any ratio has been agreed among partners for the distribution of share, these must

be distributed in that ratio.

(b) If the partners want that dividend from the new company should be distributed

in the old profit-sharing ratio, equity shares as well as preference shares must be

distributed in the old profit-sharing ratio.

(c) Distribution of shares in the old profit-sharing ratio means that partners are entitled

to get profit in the old profit-sharing ratio. It does not protect the right of repayment

of capital in priority over other partners. If repayment of capital is to be guaranteed

than the capital, it can be protected by allotting the preference shares because

preference shares have a priority to refund of capital over ordinary shares. Here,

dividend on these shares may correspond to the interest on capital.

(d) If any partner has given a loan to the firm, he must be satisfied by first preference

shares. This guarantees the repayment of loan (preference shares) priority over other

partners’ capital (ordinary shares). This entire process can be understood by the

following illustration:

Illustration 5 (Distribution of Shares among Partners)

Ram, Rahim and Rogers carry business in partnership under the style of M/s. R. & Co. sharing

profits and losses in the ratio of 5:3:2. They have floated R. Pvt. Ltd. for the purchase of takeover

of their business. The following is the balance sheet of the firm as on 30th September, 2011:

lovely professional university 13