Page 23 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 23

Accounting for Companies – II

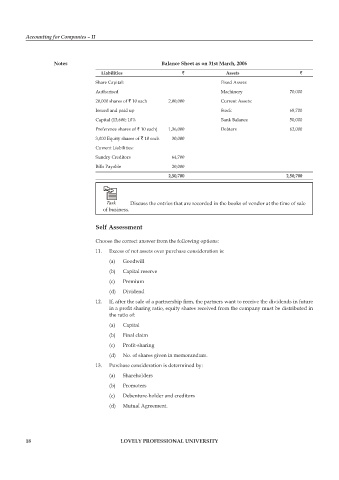

notes Balance sheet as on 31st march, 2006

liabilities ` assets `

Share Capital: Fixed Assets:

Authorised Machinery 70,000

20,000 shares of ` 10 each 2,00,000 Current Assets:

Issued and paid up Stock 68,700

Capital (13,600; 10% Bank Balance 50,000

Preference shares of ` 10 each) 1,36,000 Debtors 62,000

3,000 Equity shares of ` 10 each 30,000

Current Liabilities:

Sundry Creditors 64,700

Bills Payable 20,000

2,50,700 2,50,700

Task Discuss the entries that are recorded in the books of vendor at the time of sale

of business.

self assessment

Choose the correct answer from the following options:

11. Excess of net assets over purchase consideration is:

(a) Goodwill

(b) Capital reserve

(c) Premium

(d) Dividend

12. If, after the sale of a partnership firm, the partners want to receive the dividends in future

in a profit sharing ratio, equity shares received from the company must be distributed in

the ratio of:

(a) Capital

(b) Final claim

(c) Profit-sharing

(d) No. of shares given in memorandum.

13. Purchase consideration is determined by:

(a) Shareholders

(b) Promoters

(c) Debenture-holder and creditors

(d) Mutual Agreement.

18 lovely professional university