Page 22 - DCOM205_ACCOUNTING_FOR_COMPANIES_II

P. 22

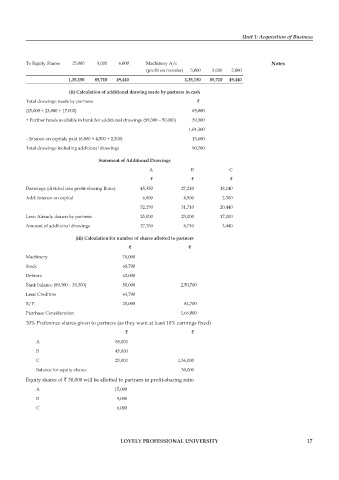

Unit 1: Acquisition of Business

To Equity Shares 15,000 9,000 6,000 Machinery A/c notes

(profit on transfer) 5,000 3,000 2,000

1,35,150 85,710 49,440 1,35,150 85,710 49,440

(ii) calculation of additional drawing made by partners in cash

Total drawings made by partners `

(25,000 + 23,000 + 17,000) 65,000

+ Further funds available in bank for additional drawings (89,300 – 50,000) 39,300

1,04,300

– Interest on capitals paid (6,800 + 4,500 + 2,300) 13,600

Total drawings including additional drawings 90,700

statement of additional Drawings

A B C

` ` `

Drawings (divided into profit-sharing Ratio) 45,350 27,210 18,140

Add: Interest on capital 6,800 4,500 2,300

52,150 31,710 20,440

Less: Already drawn by partners 25,000 23,000 17,000

Amount of additional drawings 27,150 8,710 3,440

(iii) calculation for number of shares allotted to partners

` `

Machinery 70,000

Stock 68,700

Debtors 62,000

Bank balance (89,300 – 39,300) 50,000 2,50,700

less: Creditors 64,700

B/P. 20,000 84,700

Purchase Consideration 1,66,000

10% Preference shares given to partners (as they want at least 10% earnings fixed)

` `

A 68,000

B 45,000

C 23,000 1,36,000

Balance for equity shares 30,000

Equity shares of ` 30,000 will be allotted to partners in profit-sharing ratio

A 15,000

B 9,000

C 6,000

lovely professional university 17