Page 280 - DCOM504_SECURITY_ANALYSIS_AND_PORTFOLIO_MANAGEMENT

P. 280

Unit 11: Capital Market Theory

portfolio or investment is a combination of risk free return plus risk premium. An investor will Notes

come forward to take risk only if the return on investment also includes risk premium. CAPM

provides an intuitive approach for thinking about the return that an investor should require on

an investment, given the assessed systematic or market risk.

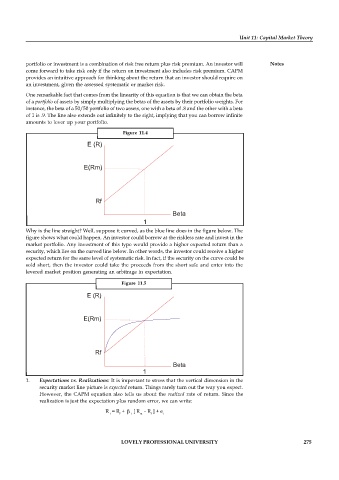

One remarkable fact that comes from the linearity of this equation is that we can obtain the beta

of a portfolio of assets by simply multiplying the betas of the assets by their portfolio weights. For

instance, the beta of a 50/50 portfolio of two assets, one with a beta of .8 and the other with a beta

of 1 is .9. The line also extends out infinitely to the right, implying that you can borrow infinite

amounts to lever up your portfolio.

Figure 11.4

E (R)

E(Rm)

Rf

Beta

1

Why is the line straight? Well, suppose it curved, as the blue line does in the figure below. The

figure shows what could happen. An investor could borrow at the riskless rate and invest in the

market portfolio. Any investment of this type would provide a higher expected return than a

security, which lies on the curved line below. In other words, the investor could receive a higher

expected return for the same level of systematic risk. In fact, if the security on the curve could be

sold short, then the investor could take the proceeds from the short sale and enter into the

levered market position generating an arbitrage in expectation.

Figure 11.5

E (R)

E(Rm)

Rf

Beta

1

1. Expectations vs. Realizations: It is important to stress that the vertical dimension in the

security market line picture is expected return. Things rarely turn out the way you expect.

However, the CAPM equation also tells us about the realized rate of return. Since the

realization is just the expectation plus random error, we can write:

R = R + [ R – R ] + e

i f i m f i

LOVELY PROFESSIONAL UNIVERSITY 275