Page 69 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 69

Management Control Systems

Notes the divisional manager but should be considered in overall segment performance by

comparison with the budget and with the division’s results for the prior period.

7. Segment profit contribution: This is the difference between controllable segment margin

and the attributable segment costs. Variance analysis, percentage analysis of individual

costs and revenues, and trend and time period analysis can be used to evaluate the various

components of segment profit contribution. Comparison can be made with industry

standards.

8. Common firm wide costs: These costs are incurred for the firm as a whole and do not relate

specifically to any segment. These costs are to be allocated to the segments on some

appropriate basis, so as to reflect the correct profitability of the segment. The basis of

allocation reflects the relative amount of expenses that is incurred for each segment or the

amount of benefit received by each unit.

Notes There are two arguments against such allocations. First, the costs incurred by

corporate staff departments such as CEO’s office, finance, accounting and human resources

are not controllable by profit centre managers. Second, it is difficult to find a proper

acceptable basis for allocating the costs that would properly reflect the relative amount of

corporate costs caused by each profit centre.

There are, however, arguments for and against allocating corporate overheads to profit

centres:

(i) Profit centre performance can be comparable to competitors.

(ii) Corporate service units have a tendency to “empire build” to increase their power

base and make their departments excellent, without regard for their values to the

company. If such costs are allocated to profit centres, the profit centre managers will

raise questions about the amount of corporate overhead, this helps to keep a check

on spending at the corporate office.

(iii) The profit centre manager is given the message that the profit centre has not earned

a profit it recovers all costs, including a share of allocated corporate overhead. Thus,

profit centre managers would be motivated to make optimum long-term marketing

decisions (pricing, product mix and so on) because they must keep in mind that they

must recover their share of corporate overhead.

9. Segment net income: This is equal to the difference between the segment profit contributions

minus the allocated common firm wide costs. The performance of profit centre is appraised

by comparison of actual results with budgeted amounts. In addition, data on competitors

and industry provide a good cross check on the appropriateness of the budget.

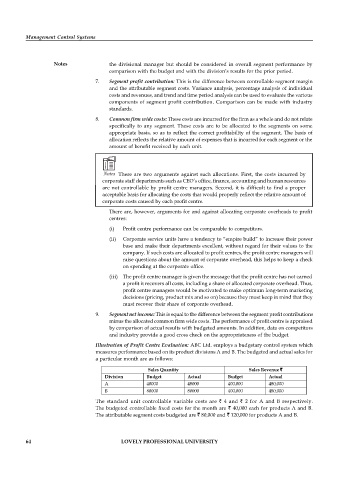

Illustration of Profit Centre Evaluation: ABC Ltd. employs a budgetary control system which

measures performance based on its product divisions A and B. The budgeted and actual sales for

a particular month are as follows:

Sales Quantity Sales Revenue `

Division Budget Actual Budget Actual

A 40000 48000 400,000 480,000

B 80000 80000 400,000 480,000

The standard unit controllable variable costs are ` 4 and ` 2 for A and B respectively.

The budgeted controllable fixed costs for the month are ` 40,000 each for products A and B.

The attributable segment costs budgeted are ` 80,000 and ` 120,000 for products A and B.

64 LOVELY PROFESSIONAL UNIVERSITY