Page 73 - DMGT514_MANAGEMENT_CONTROL_SYSTEMS

P. 73

Management Control Systems

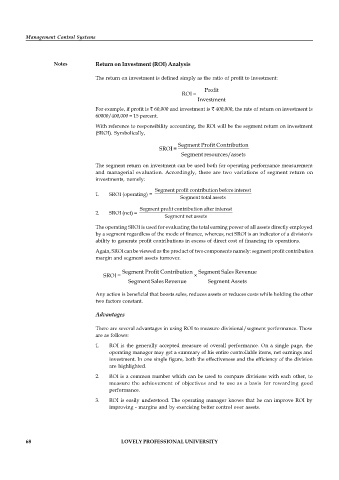

Notes Return on Investment (ROI) Analysis

The return on investment is defined simply as the ratio of profit to investment:

Profit

ROI =

Investment

For example, if profit is ` 60,000 and investment is ` 400,000, the rate of return on investment is

60000/400,000 = 15 percent.

With reference to responsibility accounting, the ROI will be the segment return on investment

(SROI). Symbolically,

Segment Profit Contribution

SROI =

Segment resources/assets

The segment return on investment can be used both for operating performance measurement

and managerial evaluation. Accordingly, there are two variations of segment return on

investments, namely:

Segment profit contribution before interest

1. SROI (operating) =

Segment total assets

Segment profit contribution after interest

2. SROI (net) =

Segment net assets

The operating SROI is used for evaluating the total earning power of all assets directly employed

by a segment regardless of the mode of finance, whereas, net SROI is an indicator of a division's

ability to generate profit contributions in excess of direct cost of financing its operations.

Again, SROI can be viewed as the product of two components namely: segment profit contribution

margin and segment assets turnover.

Segment Profit Contribution Segment Sales Revenue

SROI = ×

Segment Sales Revenue Segment Assets

Any action is beneficial that boosts sales, reduces assets or reduces costs while holding the other

two factors constant.

Advantages

There are several advantages in using ROI to measure divisional/segment performance. These

are as follows:

1. ROI is the generally accepted measure of overall performance. On a single page, the

operating manager may get a summary of his entire controllable items, net earnings and

investment. In one single figure, both the effectiveness and the efficiency of the division

are highlighted.

2. ROI is a common number which can be used to compare divisions with each other, to

measure the achievement of objectives and to use as a basis for rewarding good

performance.

3. ROI is easily understood. The operating manager knows that he can improve ROI by

improving - margins and by exercising better control over assets.

68 LOVELY PROFESSIONAL UNIVERSITY